are 529 contributions tax deductible in oregon

How much can you write off for 529 contributions. Oregon 529 Plans Tax Deductible will sometimes glitch and take you a long time to try different solutions.

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

See Additions to tax in Publication OR.

. 529 plan contributions are made with after-tax dollars. But 34 states do offer some form of tax relief on state. You also get federal income tax benefits as you do not pay income tax on your earnings.

The credit is refundable. Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved problems and equip you. Here are the special tax benefits and considerations for using a 529 plan in Oregon.

Oregon 529 Plan Tax Information. Compound interest adds up. However contributions to a 529 plan are considered completed gifts for federal tax purposes and in 2022 up to 16000 per donor 15000 in 2021 per beneficiary qualifies for the annual gift tax exclusion.

Families can deduct up to 4865 worth of these contributions from their state tax returns. Ad Getting a Child to College Can Be Stressful. LoginAsk is here to help you access Oregon 529 Tax Deduction quickly and handle each specific case you encounter.

Ratings Rankings. The Oregon 529 Savings Board. 529 plan contributions arent typically tax-deductible but they are exempt from federal and state taxes when used for qualified higher education expenses tuition room and board textbooks or other expenses related to secondary education enrollment.

When you invest with the Oregon College Savings Plan your account has the chance to grow and earn interest tax-free. That means they dont qualify for a tax deduction on your federal income taxes. Although theres no federal tax deduction for 529 contributions most states offer some kind of tax break or other incentive to contribute to their college savings plans.

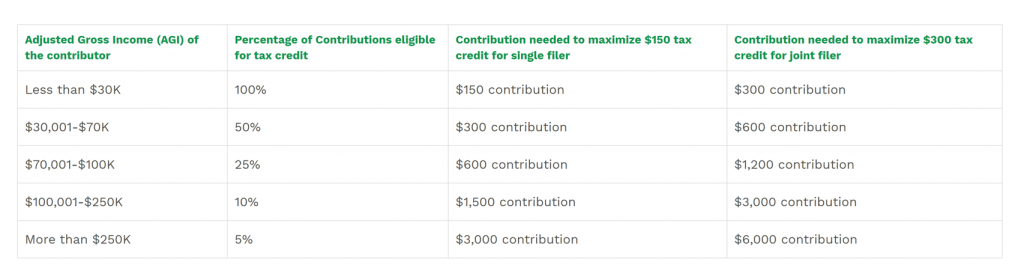

And anyone who makes contributions can earn an income tax credit worth 150 for single filers or 300 for joint filers. Deposit your Oregon personal income tax return refund into a preexisting Oregon College Savings Plan or MFS 529 Savings Plan account. However there are maximum aggregate limits which vary by plan.

Credit recaptures for Oregon 529 College Savings Network and ABLE account contributions. State definition of qualified expenses. If you claimed a tax credit based on your contributions to an Oregon College or MFS 529 Savings Plan account or an ABLE account and later made a nonqualified withdrawal of those contributions your credits may have to be recaptured.

Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved problems. 529 plan contributions arent typically tax-deductible but they are exempt from federal and state taxes when used for qualified higher education expenses tuition room and. For more information about 529 Contributions visit.

On a federal-level there is no tax savings for contributions but qualified distributions are tax-free. LoginAsk is here to help you access Oregon 529 Plans Tax Deductible quickly and handle each specific case you encounter. Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved problems and.

529 plans typically increase the contribution limit over time so you may be able to contribute more. State tax recapture provisions. 529 plans do not have annual contribution limits.

Oregon 529 Tax Deduction will sometimes glitch and take you a long time to try different solutions. 2021 529 Deduction Maximum Oregon will sometimes glitch and take you a long time to try different solutions. People who put money into a 529 account can deduct that contribution from their taxable state income up to 4660 in 2017 for married couples filing jointly.

Include Schedule OR-529 with your Oregon personal income tax return. Previously Oregon allowed tax-deductible contributions. Program match on contributions.

All Oregon tax payers are eligible to contribute to an Oregon College Savings Plan MFS 529 Savings Plan or Oregon ABLE Savings Plan and claim the state tax credit. Single filers can deduct up to 2435. In the past contributions to the Oregon 529 Plan were deductible on your Oregon state income tax return up to certain limits.

Oregon doesnt offer tax deductions. Earnings from 529 plans are not subject to federal tax and generally not subject to state tax when used for qualified education expenses such as tuition fees books as well as room and board. LoginAsk is here to help you access 2021 529 Deduction Maximum Oregon quickly and handle each specific case you encounter.

An Oregon tax credit of up to 150 300 if married filing jointly is available. Tax savings is one of the big benefits of using a 529 plan to save for college. Direct Deposit To deposit all or a portion of your refund into an Oregon College Savings Plan or MFS 529 Savings.

If you are a resident of Oregon contributions made to any account in the Oregon College Savings Plan are eligible to receive a state income tax credit up to 300 for joint filers. You do not need to be the owner of the account to contribute and claim the tax credit. Previously Oregon allowed tax-deductible contributions.

Even though every state has a plan they are not all the same. Oregon offers a tax credit for 529 plan contributions but I do not see the place to input this in TurboTax. And Oregonians can still take advantage of this perk based on the contributions they made before December 31 2019.

The contributions made to the 529 plan however are not deductible. When you click on Oregon 529 College Savings Credit one box pops up for you to enter all contributions. Oregon has an additional incentive.

State tax deduction or credit for contributions. Create an Oregon College Savings Plan account. Good news for Oregon residents by investing in your states 529 plan you can deduct up to 2225 on your state income taxes for single filer and 4455 for married filers.

Never are 529 contributions tax deductible on the federal level. And as with any 529 plan your money grows. 2020 is the first year the subtraction is no longer allowed credit only.

Explore the benefits and see how saving for your kids future can help come tax season. Youll enjoy a deduction of up to 10000 per year 20000 if married and filing jointly and you pay no state income tax on earnings and withdrawals that are used for qualified college expenses 1You can also deduct the contribution portion but not earnings of rollovers from other state 529 plans. Get Fidelitys Guidance at Every Step.

In 2019 individual taxpayers were allowed to.

The Top 9 Benefits Of 529 Plans Savingforcollege Com

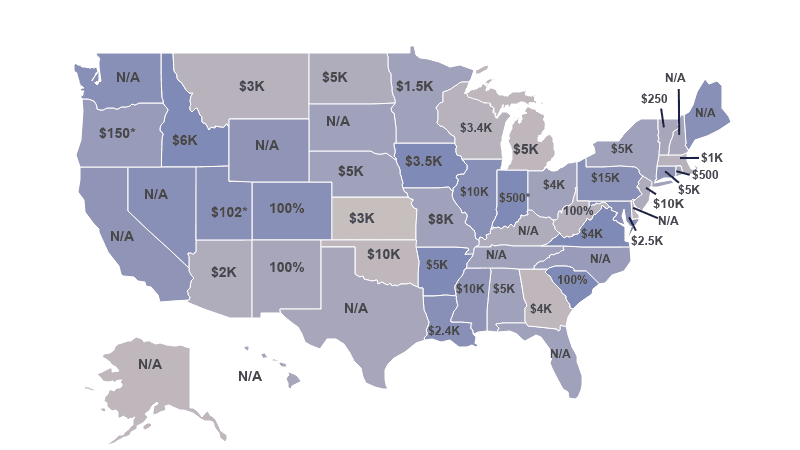

529 Tax Deductions By State 2022 Rules On Tax Benefits

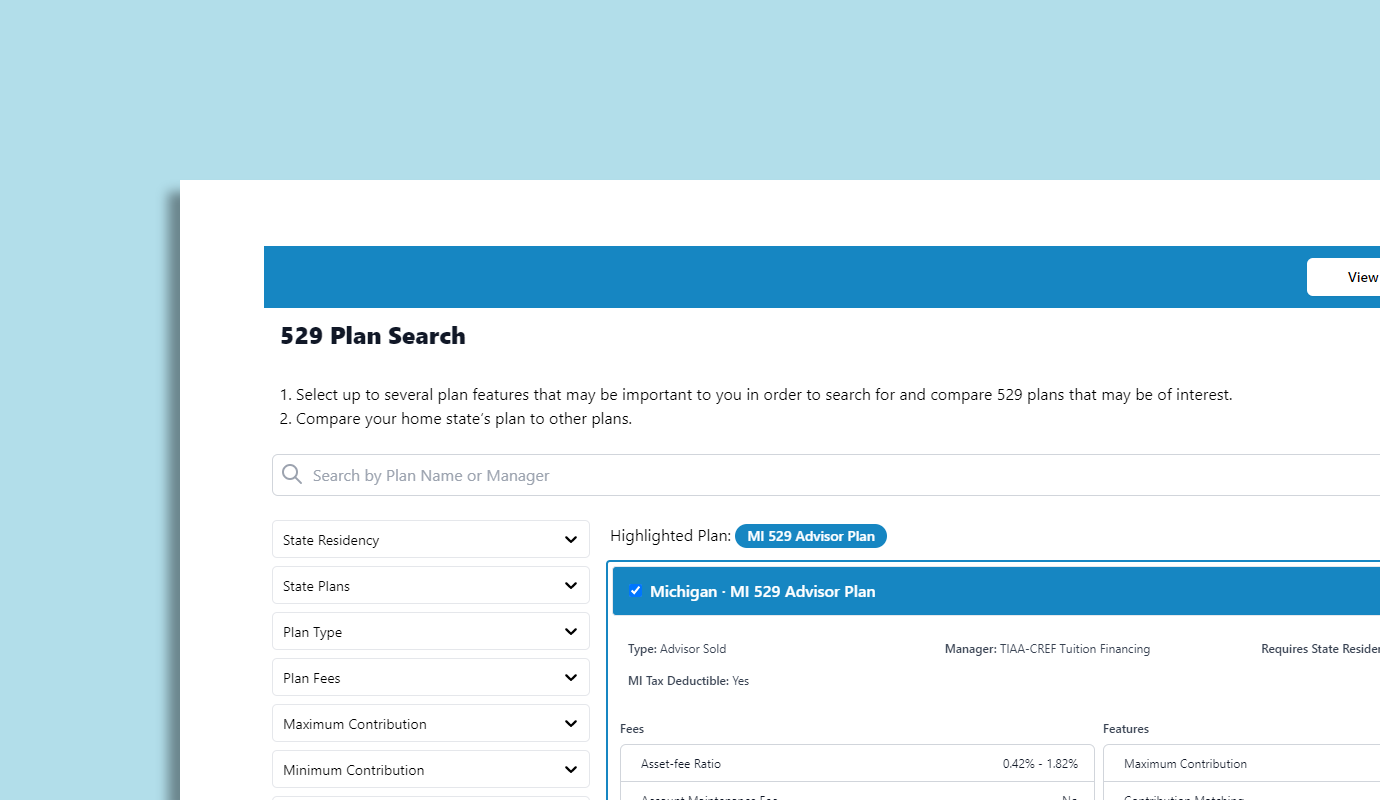

529 Plan State Tax Fee Comparison Calculator 529 Plans Nuveen

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

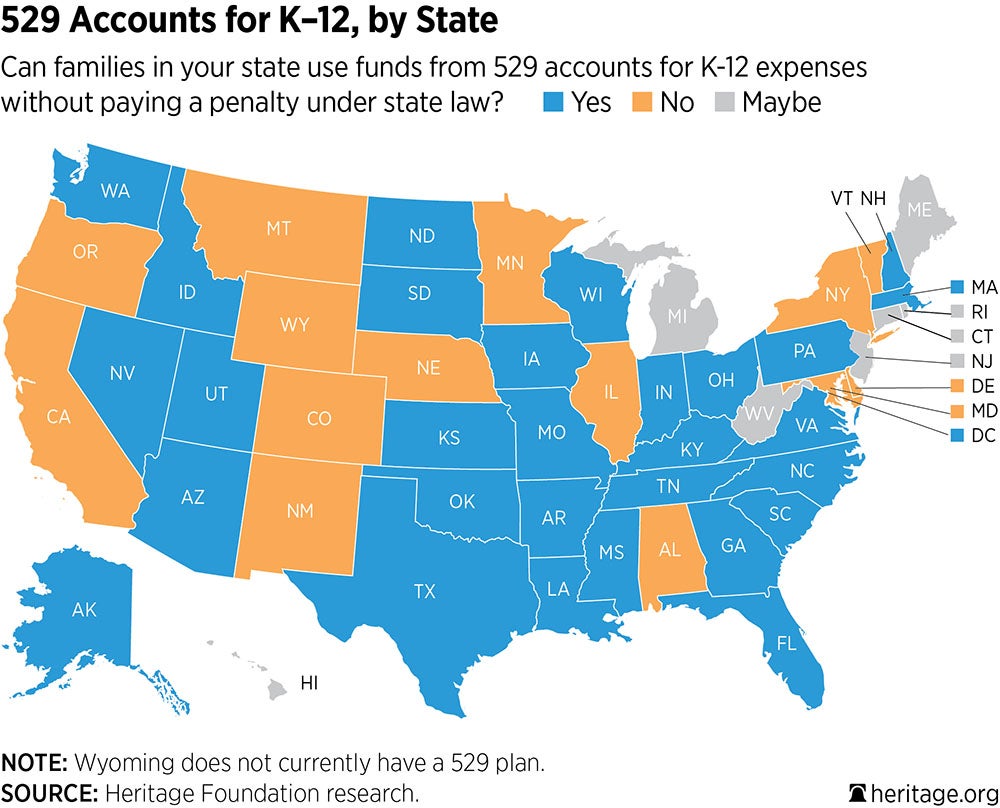

529 Accounts In The States The Heritage Foundation

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans State Tax 529 College Savings Plan

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

10 Things Parents Should Know About College Savings

How Much Can You Contribute To A 529 Plan In 2022

Kiplinger S Picks Saving For College College Savings Plans 529 College Savings Plan

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

529 Plans Which States Reward College Savers Adviser Investments

529 Plans Which States Reward College Savers Adviser Investments

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Where Do I Enter Contributions To A 529 Plan For Tax Year 2020 On The Federal And Or Colorado State Return I Only See The Option To Report Distributions From A 529